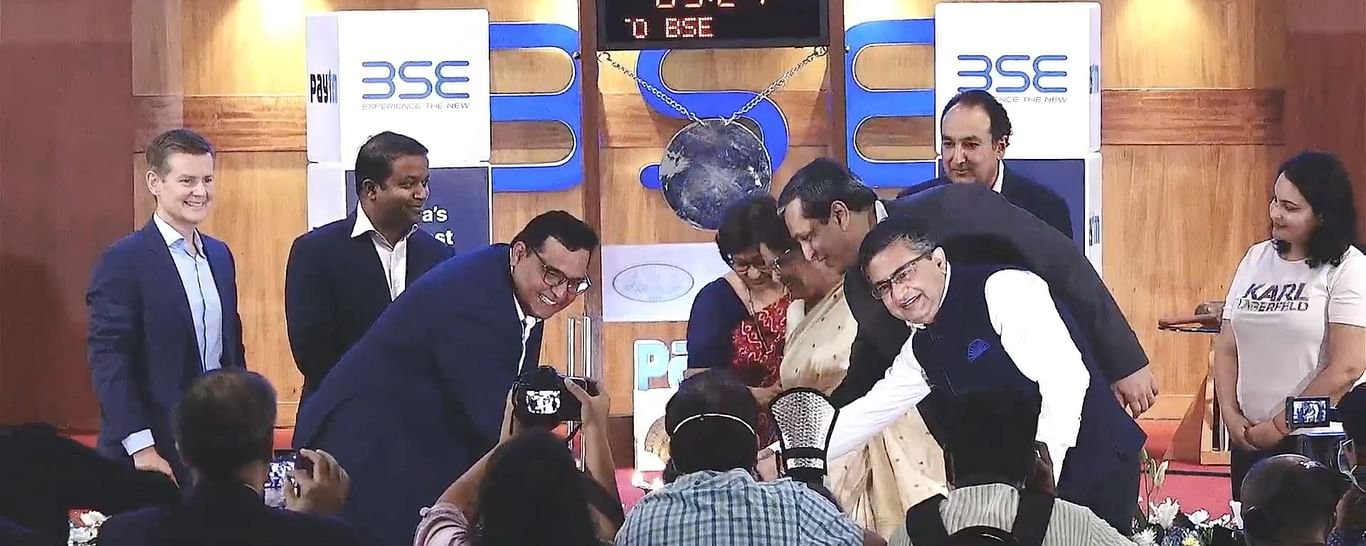

Indian food delivery firm Zomato, which went public earlier this year, is making a series of investments in startups as it looks for ways to inorganically expand its business in the world’s second-largest internet market.

The firm, which has a market cap of over $14.3 billion, said in a Wednesday filing that it is investing in logistics firm Shiprocket, savings app Magicpin and fitness startup Curefit. TechCrunch reported about these deals earlier on Wednesday.

Zomato said it is investing $75 million in Delhi-headquartered Shiprocket. The investment is part of a ~$185 million financing round, Zomato said. The investment values Shiprocket at over $930 million, Zomato disclosed in the filing on a local exchange.

In Magicpin, Zomato is investing $50 million to acquire a 16% stake, it said. The investment is part of a broader $60 million financing round, Magicpin confirmed to TechCrunch.

“Local retail is the lifeblood of our country. magicpin is helping drive omni-channel growth for local retail and enabling them to leverage the fast growing digital world. We are excited about welcoming Zomato into the company – this round puts us in a position to own and transform the offline shopping experience across India,” said Anshoo Sharma, co-founder and chief executive of Magicpin, in a statement.

Zomato said it is selling its fitness service Fitso to Curefit for $50 million for stake in the Bangalore-based startup and also investing an additional $50 million in the firm. In total, Zomato is gaining a 6.4% stake in Curefit, minting another unicorn in the country.

“This will help us potentially explore cross-selling benefits between Zomato and Curefit, as we see food and health becoming the same side of the coin in the long term,” Zomato said.

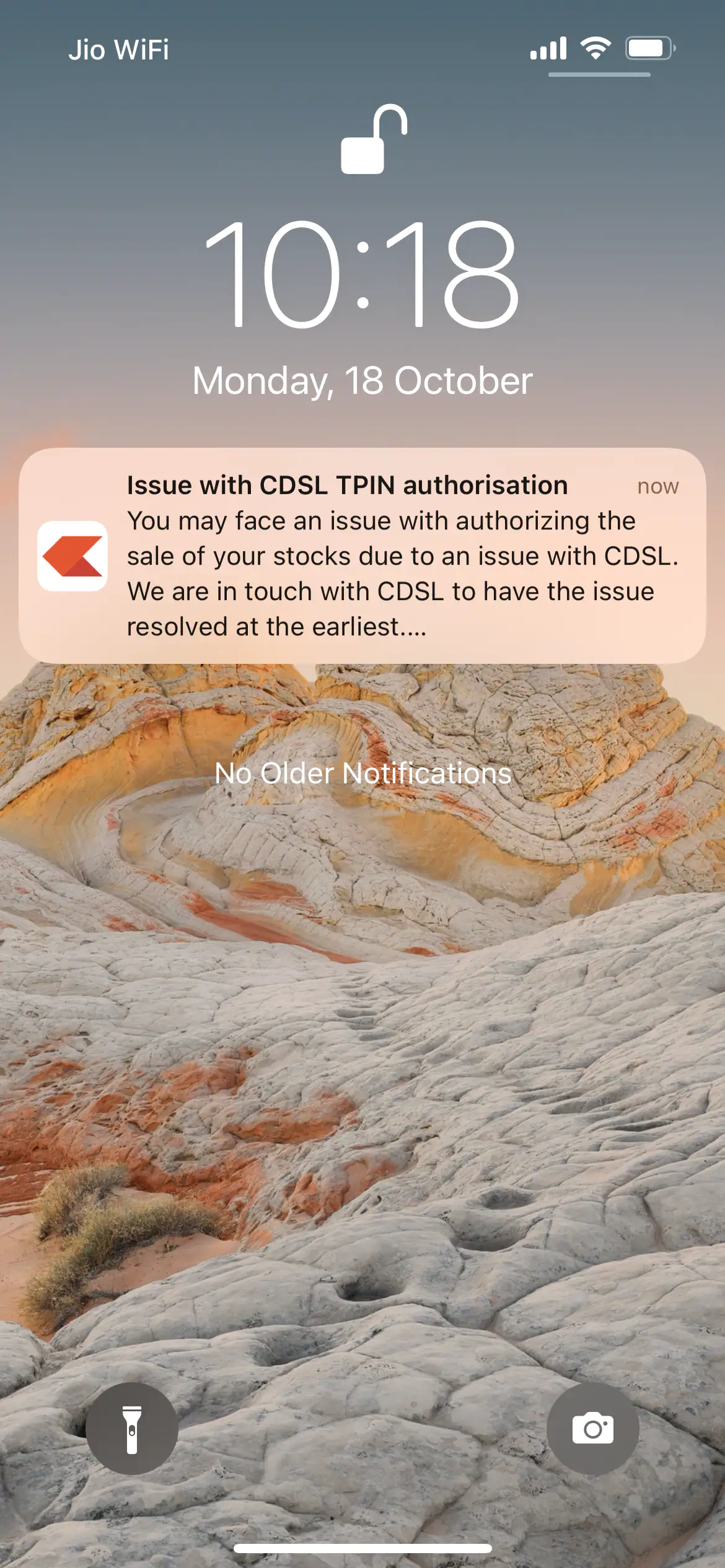

Zomato also reported its financials for the quarter that ended in September. The firm said its adjusted revenue in the quarter was $189 million, a 22.6% growth quarter-over-quarter, while its loss ballooned to $41 million, up from $22 million in the prior quarter. Its adjusted revenue for the first half of the financial year stood at $344 million.

Deepinder Goyal, co-founder and chief executive of Zomato, has explored investment opportunities in his personal capacity as well as through the firm in at least over half a dozen startups in recent months, according to sources at many of those firms.

In June, the publicly listed firm Zomato invested $100 million in online grocer Grofers, and according to two people familiar with the matter, has told the younger firm that it is open to fully acquiring it at a later stage if certain metrics are achieved.

Zomato said it has invested $275 million across four companies in the past six months. It plans to deploy another $1 billion over the next 1-2 years, “with a large chunk of it likely to go into the quick-commerce space,” it said.

“Within all the businesses that we are looking at today, quick-commerce (delivery of products in less than 30 minutes) is clearly emerging as one of the most promising ones. While we decided to not build quick-commerce on our platform, we are excited about the progress our partner company Grofers has made in the 10-min delivery space. High online grocery penetration has remained elusive in India for the past 7-8 years but we feel we might be finally witnessing the inflection point here with the widespread adoption we are seeing in the 10-min delivery format. We are likely to invest more in this space in the near term.” it said.