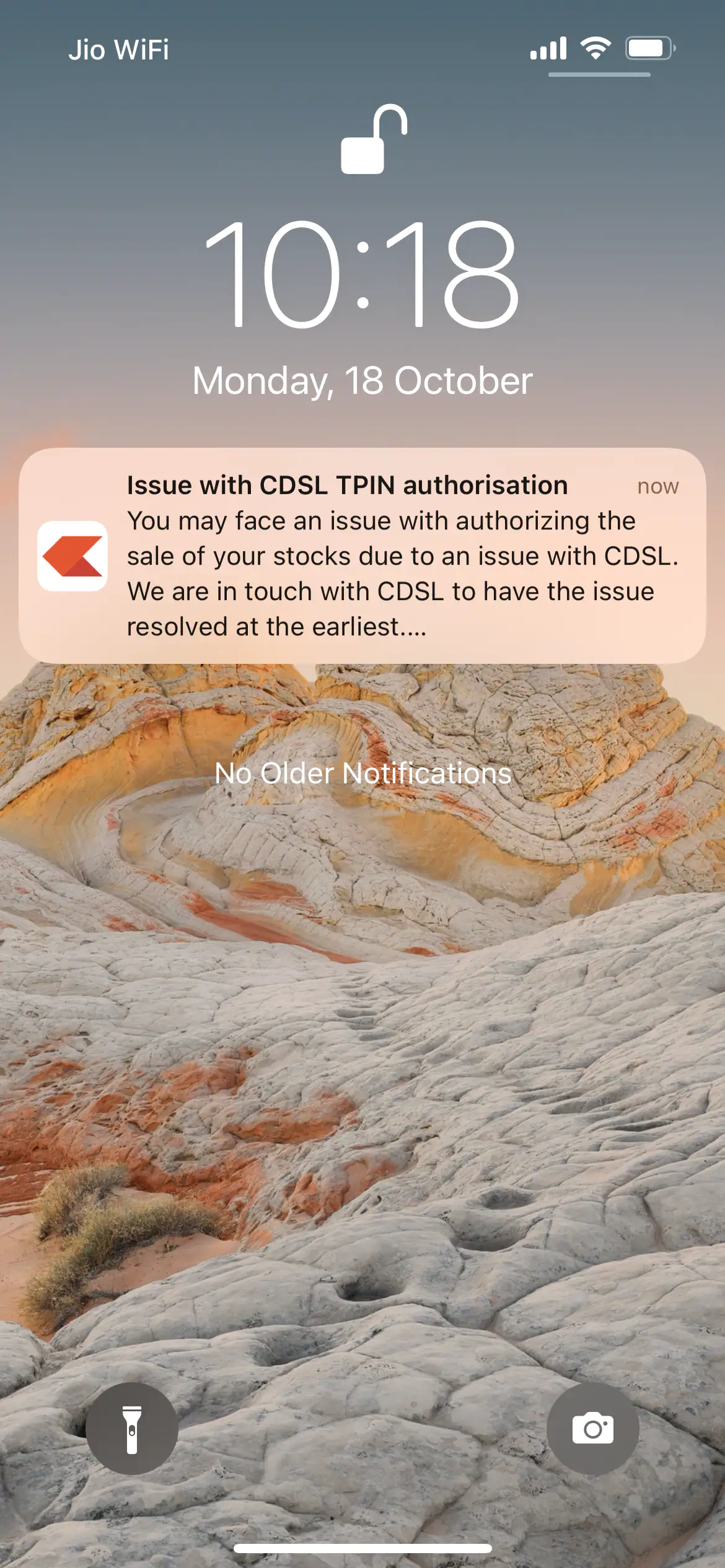

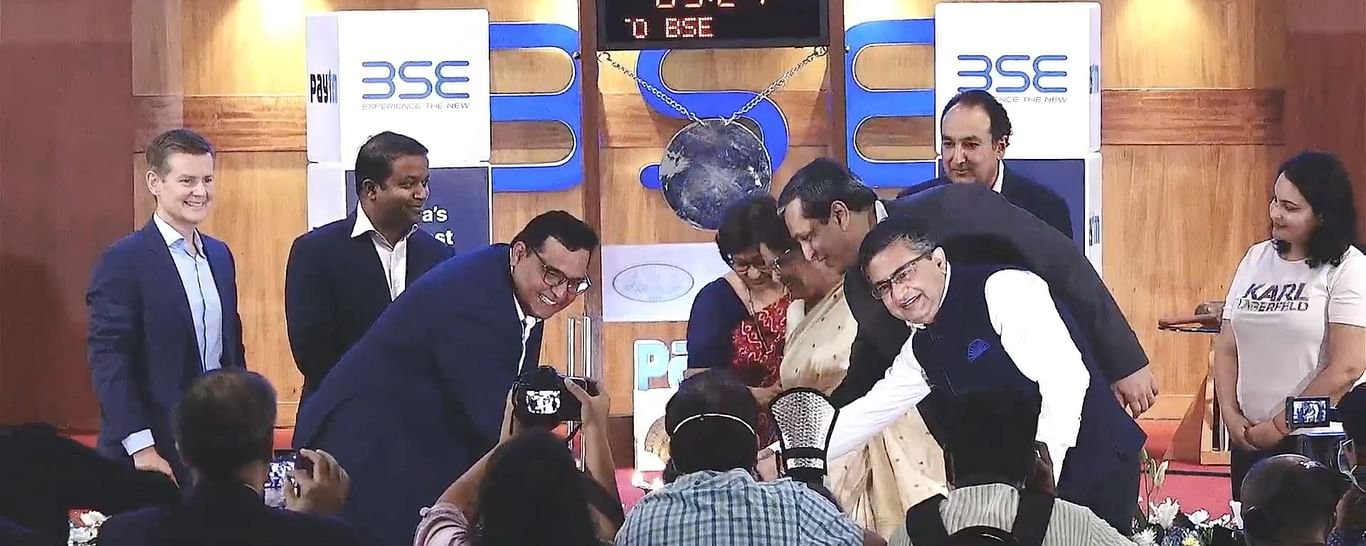

Versatile installments firm Paytm is good to go for its Rs 18,300 crore first sale of stock, which will occur between November 8 and 10 at a value band of Rs 2,080-2,150, the organization said in its Red Herring Prospectus gave on October 27.

This is promoted to be India’s biggest market debut, a record that was recently held by Coal India, which raised Rs 15,000 crore longer than 10 years prior.

The organization which had arranged a Diwali posting got deferred on its arrangements by longer than seven days following a postponement in endorsement by the Securities and Exchange Board of India (SEBI).

Paytm is at present India’s second most-significant web organization, last esteemed at $16 billion when it brought a billion dollars up in November 2019 drove by T Rowe Price, Discovery Capital and D1 Capital.

The public proposition is relied upon to take the organization’s valuation to $20 billion.

On October 27 revealed that the organization’s distraction plan (RHP) is relied upon to come out as right on time as this week.

The organization which was before intending to raise Rs 16,600 crore amended the sum to Rs 18,300 crore following an expanded financial backer interest.

According to the archive, while the new issue is Rs 8,300 crore the proposal available to be purchased comprises of Rs 10,000 crore which incorporates Rs 402 crore of total measure of value shares presented by originator Vijay Shekhar Sharma.

Other people who will sell their stakes incorporate Ant Financials at Rs 4,704 crore, Alibaba at Rs 784 crore, and SAIF III Mauritius Company at Rs 1,327 crore.

Paytm had recorded its Draft Red Herring Prospectus (DRHP) with the market controller in July.

It will be recorded on the Bombay Stock Exchange and the National Stock Exchange.

The organization is relied upon to utilize the essential returns for development including client and dealer procurement and putting resources into new business drives, acquisitions, and key associations.

Paytm had timed income of Rs 3,186 crore for FY 20-21 versus Rs 3,540 crore in the earlier year. It restricted misfortunes to Rs 1,701 crore during a similar period from Rs 2,942 crore in the earlier year.

One97 Communications, the parent firm of Paytm, was established by Vijay Shekhar Sharma in 2000. It started its excursion as a worth added specialist co-op, and developed throughout the years to turn into an internet based versatile installments firm.

The organization went through right around 10 years taking into account the VAS market. It caused its first turn with the dispatch of a portable to re-energize stage in 2010. Up to that point, clients used to pay money to get their telephones re-energized by disconnected retailers. More than 90% of Indian telecom clients had prepaid associations in India at that point. After ten years, the market hasn’t changed a lot.

For the three months finished June 2021, Paytm has seen a tremendous uptick in its incomes driven by its installments and monetary administrations contributions.

The organization’s income was up by 46% to Rs 948 crore in the principal quarter of monetary year 2022 from Rs 649 crore in the like time of the past monetary year. Paytm’s misfortunes remained at Rs 3,82 crore for the three months finished June 2021.

Right now, Paytm is wagering enthusiastic about its loaning vertical. Furthermore, according to its RHP in the second quarter of monetary year 2022, it dispensed 2.84 million advances.

Strangely, this isn’t One97’s first endeavor to open up to the world. In 2010, the organization, which then, at that point, used to offer some incentive added administrations (VAS) for telecom clients, intended to raise Rs 120 crore ($28 million, premise 10 years old transformation rate) through an IPO. It needed to drop its arrangement as a result of market unpredictability.

The organization at present has around 10,266 workers.