Online food ordering company Zomato, which listed earlier in 2021, is under tremendous pressure, said founder Deepinder Goyal. He added that the love it used to get from the industry before the IPO had vanished and there was a lot of work that remained to be done.

“There is a lot of pressure post the IPO. Till three days ago we used to get a lot of love… did so much work around Covid. But everybody forgot everything after the IPO which is painful to see (sic),” Goyal said at a panel of Maximum India Conclave organised by Indian Private Equity and Venture Capital Association.

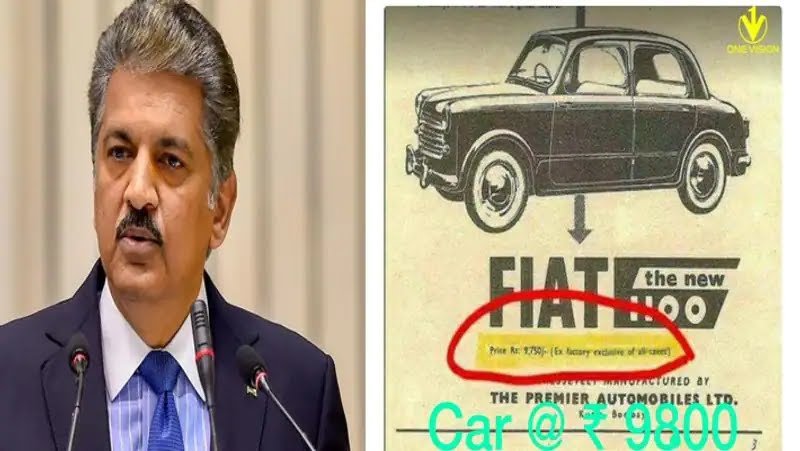

He was referring to the conversations around the company’s high valuation around the time of the initial public offering. In its last funding round before the IPO, Zomato was valued at $5.4 billion – about 15 times its sales for financial year 2020.

This came after ace investor who is also often called as the Warren Buffet of India Rakesh Jhunjhunwala snubbed the company’s IPO stating that he wouldn’t buy its shares at the given valuation.

Goyal who was speaking three months after Zomato’s impressive debut on the bourses also said that the job wasn’t done, “there’s a lot to do.” He also candidly added that he avoided checking the prices of his company’s shares on a regular basis. “Seen stock price only thrice after going public,” he said.

Talking about young companies going for IPOs, Goyal said, “if these cycles are shorter we can iterate faster.”

Sanjeev Bikhchandani, one of Zomato’s earliest investors also reminisced about an incident when he didn’t want the company to start delivery of food. Zomato was conventionally in the restaurant discovery space. In the panel which took place on October 9, Bikhchandai said, “Told Deepinder delivery wasn’t a good idea, and I am glad he didn’t listen to me.”

“Didn’t know if it (delivery) was good or not but I knew if we didn’t do it, this company was done. It was a make or break kind of a situation for us,” said Goyal.

Mohit Bhatnagar, managing director of Sequoia who invested in the company soon after Bikhchandani also said that as an entrepreneur what made Goyal different from many others was his “audacity to be ambitious”.

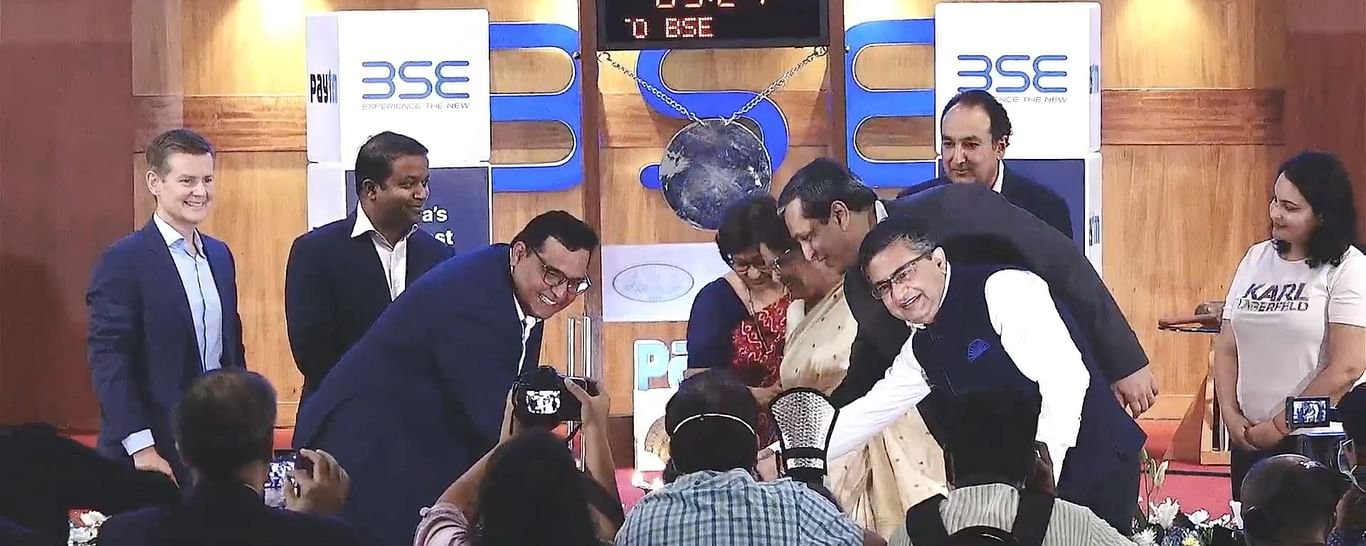

Zomato has witnessed a good amount of restructuring after getting listed.

It shut down its grocery delivery service and nutraceutical segment. While its re-entry into grocery was recent, Zomato had ventured into the nutraceutical business a year ago with the launch of health and fitness products.

The company decided to shut it at a time when the government is trying to get stricter about private label norms for marketplace businesses in the country.

These are not all, Zomato literally went on a ‘cleaning-up’ drive.

In September, it also announced the closure of its Singapore and United Kingdom (UK)-based subsidiaries.

Before that, it also announced the winding up of its US subsidiary Nextable Inc.

The company also witnessed the exit of one of its co-founders Gaurav Gupta in September.