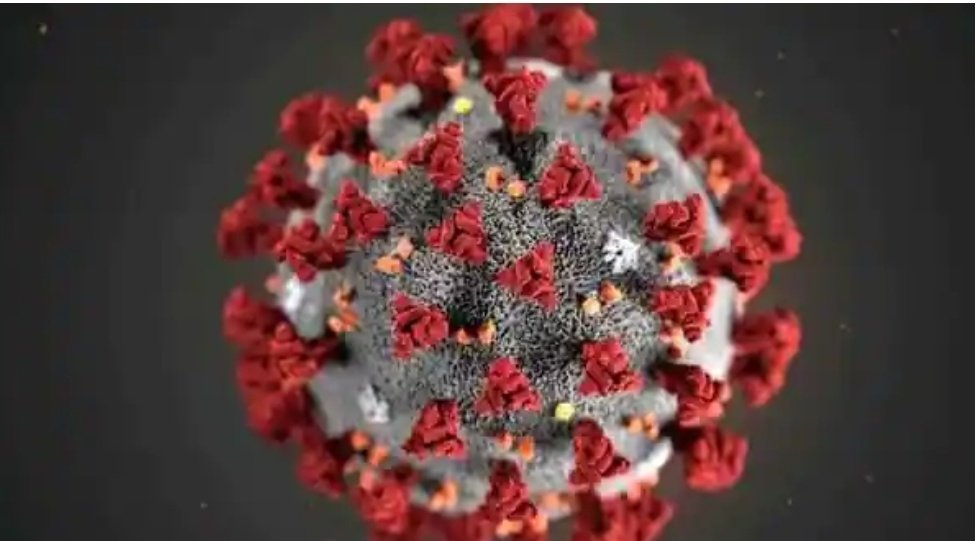

The Reserve Bank of India (RBI) on Friday decided to keep benchmark interest rate unchanged at 4 per cent but maintained an accommodative stance even as the economy is showing signs of recovery after the second COVID wave.

Consequently, the reverse repo rate will also continue to earn 3.35 per cent for banks for their deposits kept with RBI.

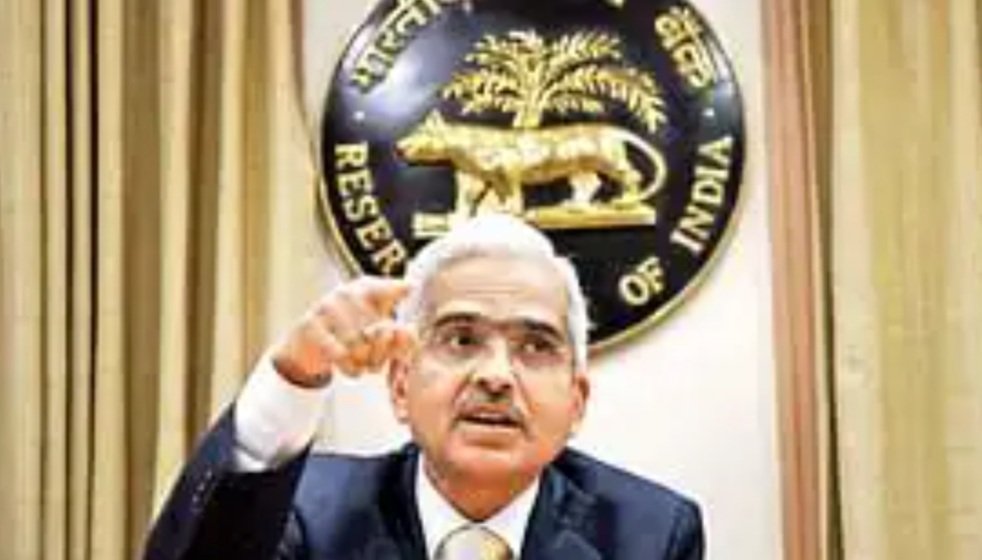

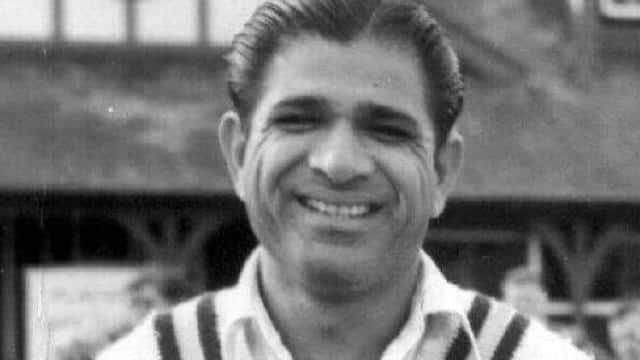

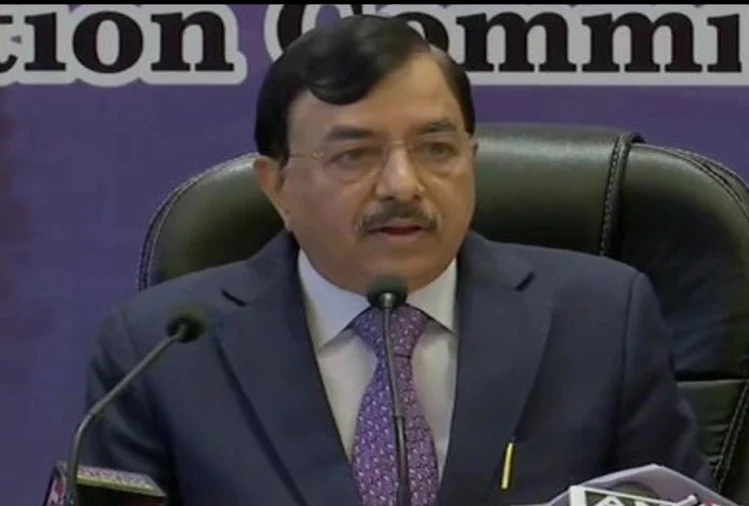

This is the eighth time in a row that the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das has maintained status quo. Since March 2020, RBI has slashed repo rates to a record low of 4 per cent through two rate cuts of 75 bps in March 2020 and 40 bps in May 2020.

“Stance to remain accommodative as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of covid-19 on the economy while ensuring that inflation remains within the target,” said RBI Governor Shaktikanta Das.

Governor Shaktikanta Das said that the MPC noted that India’s economic activity has evolved in consonance with MPC’s August assessment.

RBI had last revised its policy repo rate or the short-term lending rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low..

Das said MPC voted unanimously for keeping interest rate unchanged and decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

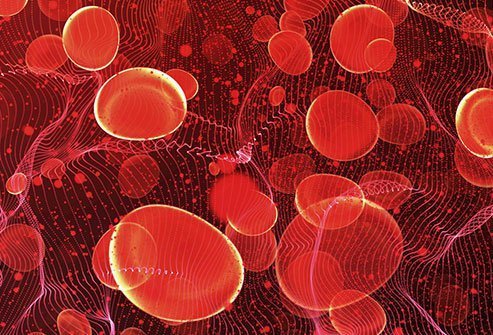

Core inflation remains sticky: RBI Governor Das

“Core inflation remains sticky”, he said. Das said that elevated global crude oil prices and other commodity prices are adding to input cost pressure.

Amidt rising fuel prices, the retail inflation stood at 5.3 per cent in August.

MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2026, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent.

Aggregate demand was improving in India but “slack still remains”. “Recovery is never and remains dependent on continued policy support,” he added.

Demand is improving, he said. RBI Governor Shaktikanta Das said that aggregate demand was improving in India but “slack still remains”. “Recovery is never and remains dependent on continued policy support,” he added.

GDP growth retained at 9.5%

The central bank is positive about 9.5 percent GDP growth estimate for FY22.

CPI inflation is projected at 5.3% for FY22

CPI inflation is projected at 5.3 percent for FY22. In Q2, it is seen at 5.1 percent, 4.5 percent in Q3, and 5.8 percent in Q4, with risks broadly balanced, RBI governor Shaktikanta Das said.

Headline inflation continues to be significantly influenced by very high inflation in select items like petrol, diesel, medicines among others, Governor Shaktikanta Das said.

“CPI inflation momentum is moderating, which favourable base effect in coming months could bring substantial softening in inflation,” said RBI Governor Shaktikanta Das.

The central bank expects CPI inflation for the year to be at 5.3 percent. The RBI is committed to bringing inflation close to the target.

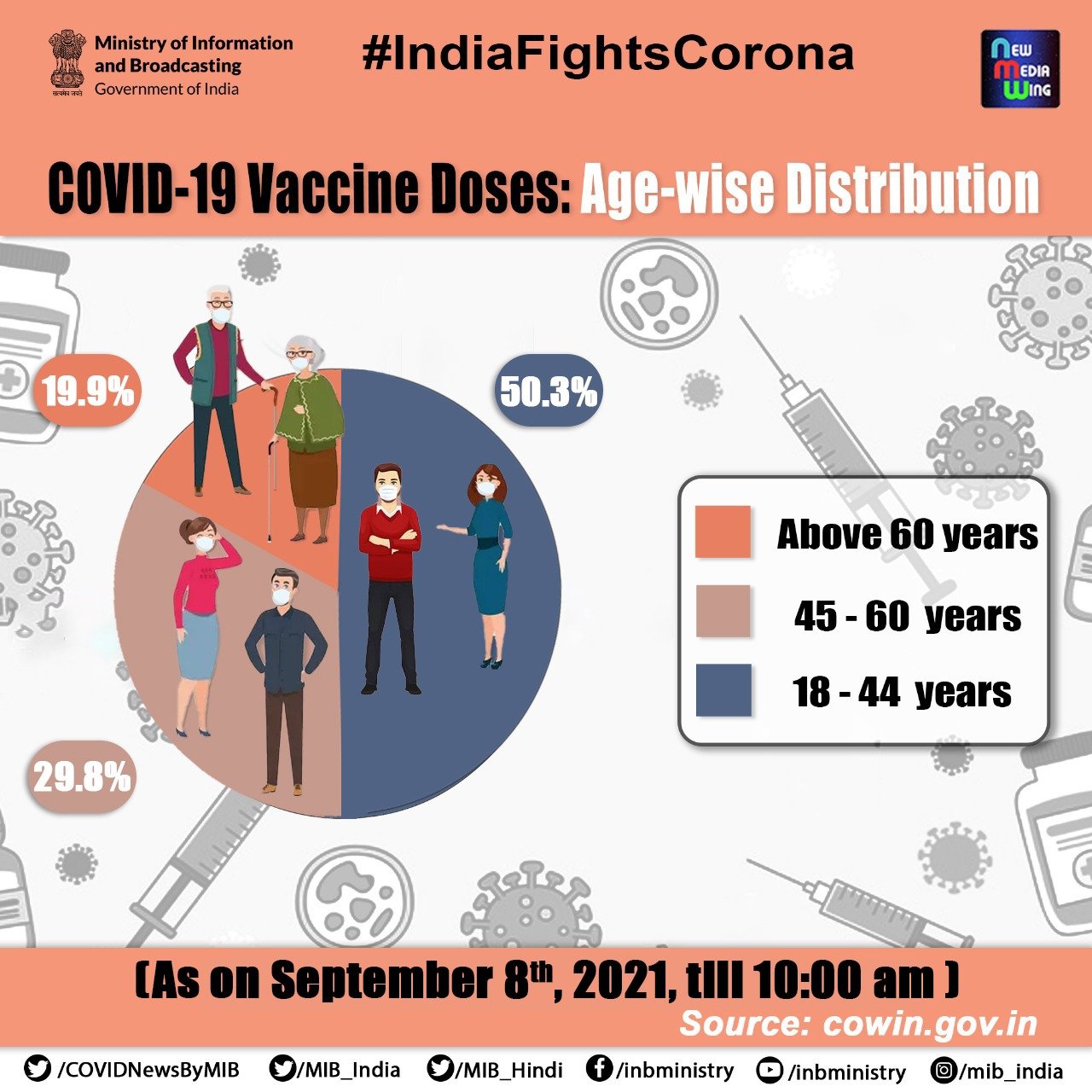

Ebbing of virus infection along with vaccination supporting private consumption.

Capacity utilisation recovers at manufacturing units

RBI Governor said that RBI survey shows that capacity utilisation at manufacturing units has recovered from the lows seen at the time of the second wave. He added that the same is expected to continue improving further.

G-Sec program successful in addressing market concerns, says RBI governor

“G-Sec program has been successful in addressing market concerns and anchoring yield expectations in the context of the large borrowing programme of the government,” the RBI governor said.

The liquidity injected into the system in the first six months of the current financial year thought OMO, including G-SAP, was Rs 2.37 lakh crore.

Rupee opens weak

The rupee opened on a weak note and fell below the 75 per US dollar level after RBI policy announcement on Friday as rising crude prices and strength of the American currency in the overseas market weighed on investor sentiments.