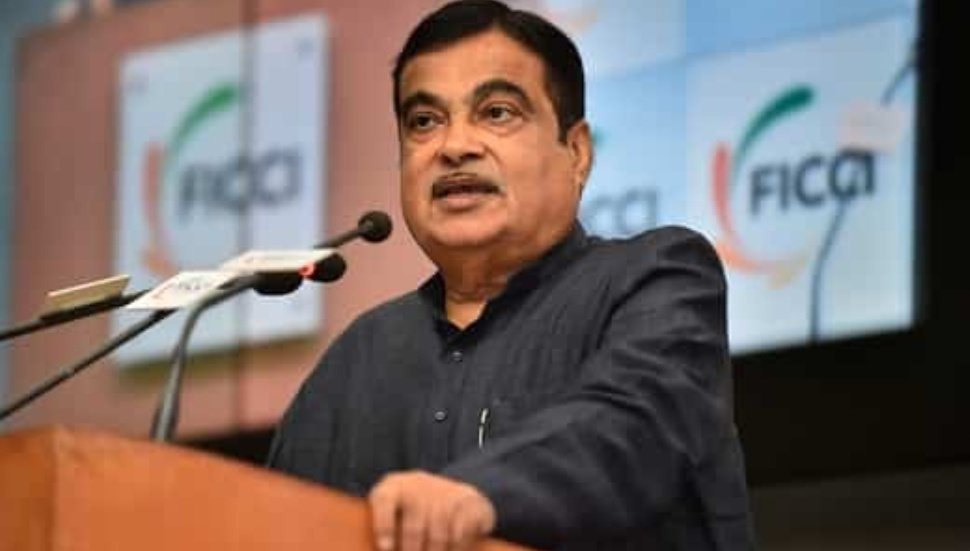

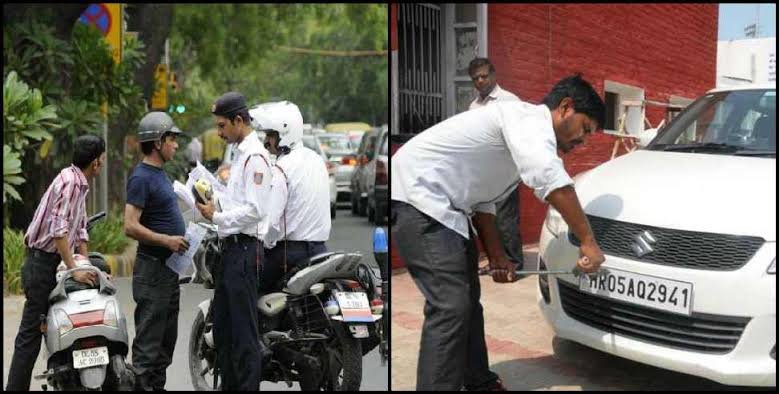

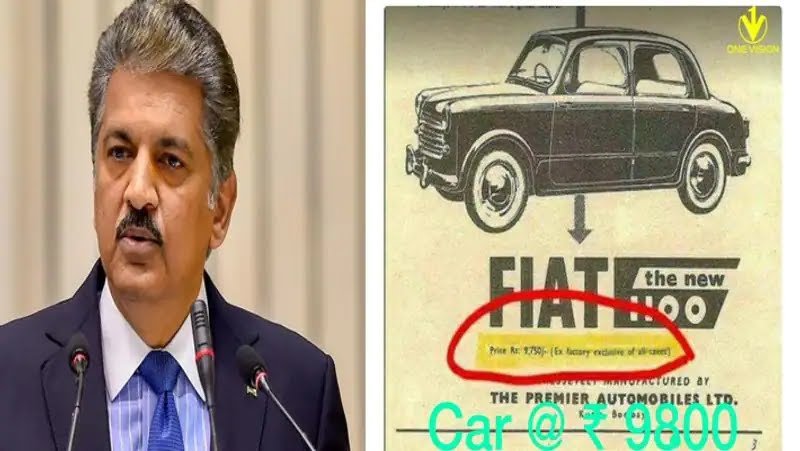

Union minister Nitin Gadkari said if petrol, diesel and other petroleum products are brought under the single, nationwide GST regime, then taxes will reduce further and both the Centre and the states will generate more revenue. Finance minister Nirmala Sitharaman will definitely try to bring petrol and diesel under GST if she gets the support of the state governments, said Gadkari while addressing the Times Now Summit virtually, as reported by news agency PTI.

“In the GST Council, finance ministers of states are also members. Some states are against bringing petrol and diesel under the GST regime. If petrol and diesel will be brought under the GST regime, then taxes on these products will be reduced and revenue of both the Centre and the states will increase,” the minister said.

Sitharaman said the Council discussed the issue only because the Kerala high court had asked it to do so but felt it was not the right time to include petroleum products under GST. “It will be reported to the High Court of Kerala that it was discussed and the GST Council felt that it wasn’t the time to bring the petroleum products into the GST,” she said following the GST council meeting.

“The way the Centre has provided relief to the common man (by cutting excise duty on petrol and diesel by ₹5 and ₹10 per litre, respectively), there is an expectation that the states will also cut taxes (VAT rates) on diesel and petrol to provide relief to the common man,” Gadkari said commenting on the recent excise duty cut.