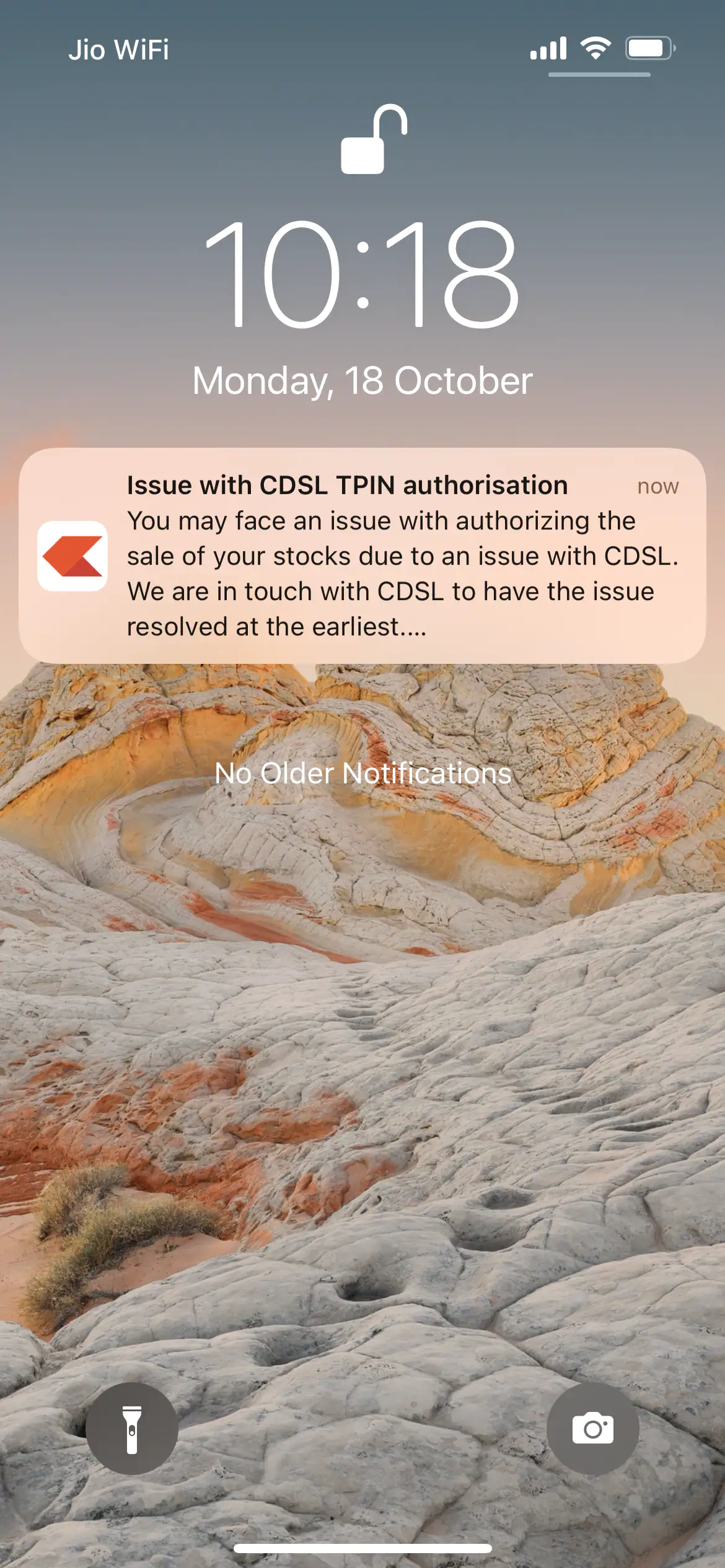

China’s transformation from a financial-technology backwater into a $46 trillion-a-year global leader in digital payments left most international investors watching in awe from the sidelines. Now India is undergoing its own fintech revolution, and the race is on to grab a piece of the action.

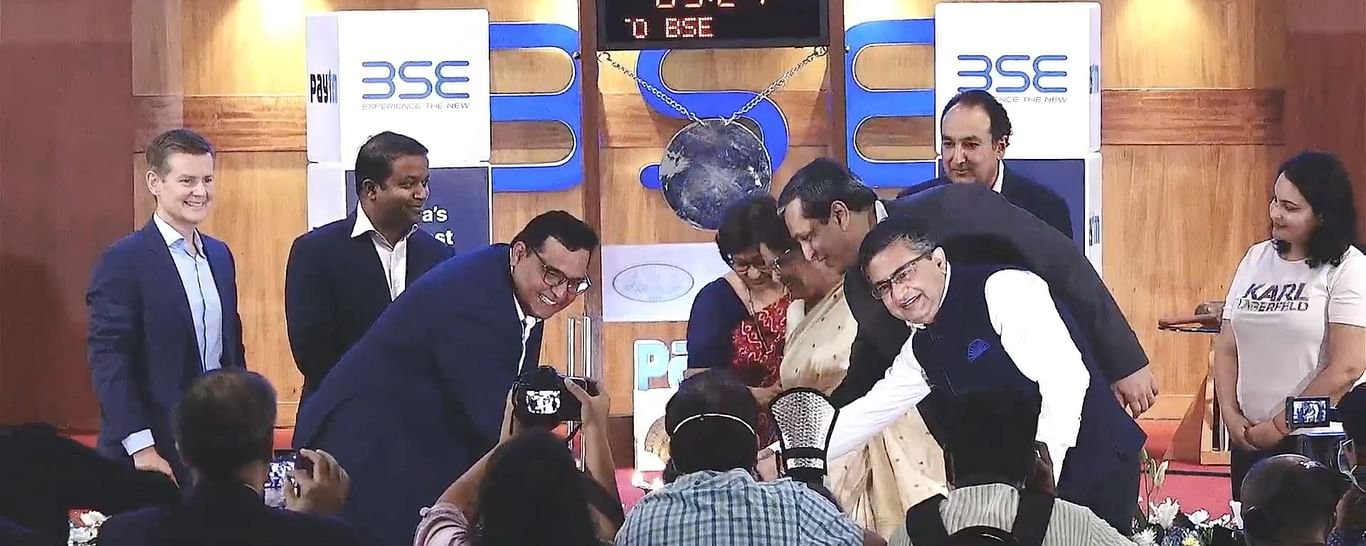

As online payments and digital loans in the second-most populous country soar at some of the fastest rates worldwide, money is pouring into India’s financial technology sector at an unprecedented pace. The sector’s sharp ascent will be on show this month as Indian payments firm Paytm — backed by foreign heavyweights including Warren Buffett’s Berkshire Hathaway Inc., China’s Alibaba Group Holding Ltd. and Masayoshi Son’s SoftBank Group Corp. — seeks a valuation of about $20 billion in what would be India’s largest ever initial public offering.

Some foreign players in India are poised to see payoffs. Berkshire Hathaway, which invested $300 million in Paytm in 2018 for a nearly 3% holding could see the value of its stake rise about 70% at a $20 billion valuation, while Paytm’s other international backers would also profit. Investment banks including Goldman Sachs Group Inc. — which is working on Paytm’s IPO — have been bolstering their teams in the country and are benefiting from the spate of deals and the flurry of fund raising.

Local fintechs like Paytm — set up by the small-town entrepreneur Vijay Shekhar Sharma who taught himself English listening to rock music — are joining Google Pay, Amazon Pay and Walmart Inc. owned PhonePe in going beyond digital payments and challenging traditional banks by venturing into the lucrative business of offering loans, mutual funds and even collecting deposits. The fintech firms have some restrictions: Local firms require them to tie-up with a lender or a regulated entity. However, armed with sophisticated cloud technology and customer data to assess risk profiles, fintechs are becoming the increasingly dominant partners of lenders in this nation of 1.4 billion, helping them reach newer customers at an extremely low cost.“What the government has done with the common fintech network in the form of the UPI is phenomenal,” Raghav Maliah, vice chairman of global investment banking at Goldman Sachs said in an interview. “It’s the equivalent of the creation of the National Highway System in the U.S. and leads us to be very bullish on possible opportunities in India.”

Investors like Ant and Softbank have said they will sell shares in the Paytm IPO. Buffett’s assistant didn’t respond to a message seeking comment.

India’s digital transactions are expected by PricewaterhouseCoopers to touch $3 trillion by March 2025 from more than $1.3 trillion now. At the heart of the meteoric rise of the Indian industry is the chutzpah of entrepreneurs like Paytm’s Sharma, who’ve had to navigate the challenges of a vast country with millions of local stores, most of whom are new to accepting digital payments. “You have to be far more Zen to survive in this country,” Sharma said in a 2019 interview with Bloomberg Markets magazine. “If you build in India, you can go build anywhere in the world. What do you think is the first thing an Indian kid learns? That the bus stop is not where the bus will stop.”

Still, digital lending in India is expected to rise to $350 billion by 2023, contributing about half of total retail loans, as estimated by Boston Consulting Group. That’s increasing the risk of cyber fraud and coercive collection practices as some smaller fintechs target financially weak customers who can’t borrow from banks. Other downsides include over-borrowing by less-financially-savvy customers.