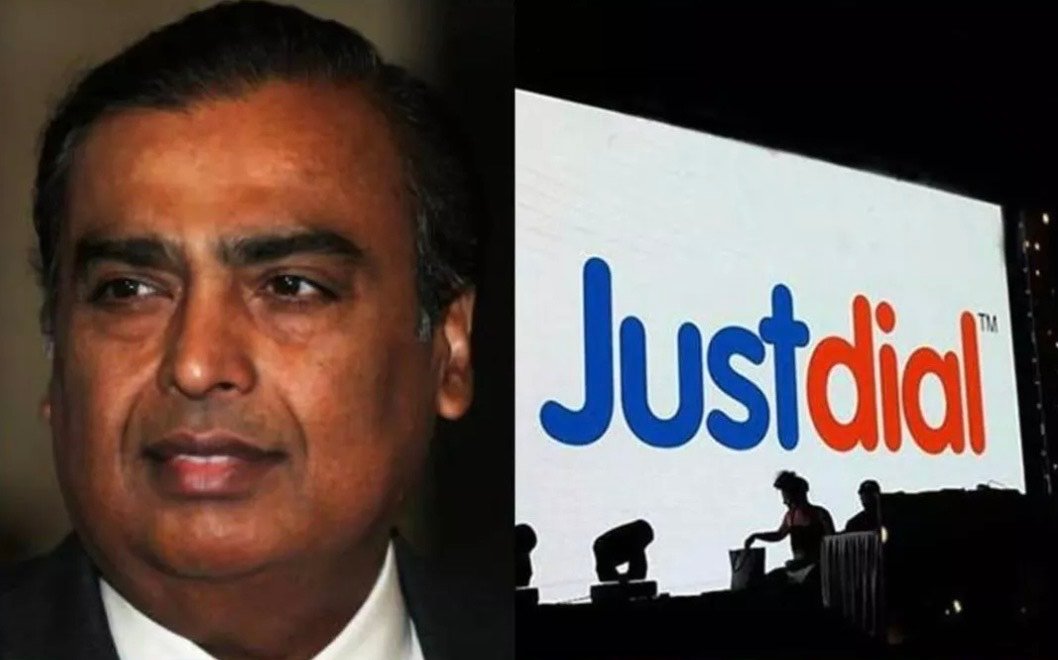

New Delhi: Billionaire Mukesh Ambani-controlled Reliance Industries (RIL) is apparently in cutting edge converses with secure neighborhood web index Justdial (JD) from its establishing advertisers in an arrangement worth Rs 5,920 crore-6,660 crore ($800-900 million).

On the off chance that the Justdial bargain goes through, it will help Reliance Retail influence the dealer information base of the 25-year-old nearby revelation stage and postings organization just as its organization across India, to additional push its own neighborhood trade and installments play in a profoundly cutthroat market, individuals acquainted with the matter told ET.

Justdial will “assess” gathering pledges proposition at its booked executive gathering tomorrow (July 16), and a last declaration is probably going to be made on that day.

Note that the Mumbai-based oil-to-telecom combination run by Ambani is as of now the biggest coordinated retailer in India while Justdial is one of the main nearby web indexes in the country with roughly 150 million normal quarterly exceptional guests across numerous stages, for example, applications, site, versatile and 8888888888 phone hotline.

The advertiser of Justdial, VSS Mani and family, holds a 35.5 percent stake in the organization which is esteemed at Rs 2,787.9 crore, as of now.

RIL is effectively considering purchasing mostly from Mani and would start an open proposal for an extra 26 percent of the association’s offers which at current costs could prompt a Rs 4,035 crore payout.

Further, if the open offer is completely bought in, RIL will bring more than 60% stake with Mani, and the organizer of Justdial will keep on running the activities as a lesser accomplice and ride the future potential gain. In any case, the exchange will likewise see an essential speculation of assets into the recorded organization by RIL.

Over the most recent a half year, portions of Justdial have effectively taken off 52.4 percent, to contact its 52-week high of Rs 1,138 to close at Rs 1,080.15 each on Wednesday (July 15). Market watchers accept the costs of the stock have flooded on assumptions for an arrangement. The computerized index organization opened up to the world in 2013 and it is getting an intense contest from the US-based tech majors like Google and Facebook.

Since April, a conversation among Reliance and Justdial is in progress however assembled pace following deal exchanges with Tata Digital self-destructed, recently. Shardul Amarchand Mangaldas and Co, Cyril Amarchand Mangaldas and Goldman Sachs are the guides in the arrangement.

In March, the vehicles to-espresso aggregate held exploratory discussions with Justdial in a sincere endeavor to get a stake in the online web search tool to reinforce Tata’s internet business presence and its destined to be dispatched own Super App.

Refering to sources, the monetary day by day announced that extremely late hiccups especially around stock value instability may influence timetables “Other than its organization and steadfast client base, a key factor is likewise JD’s nearly unassuming valuations that can be based upon,” the distribution cited an organization chief who talked on the state of secrecy.