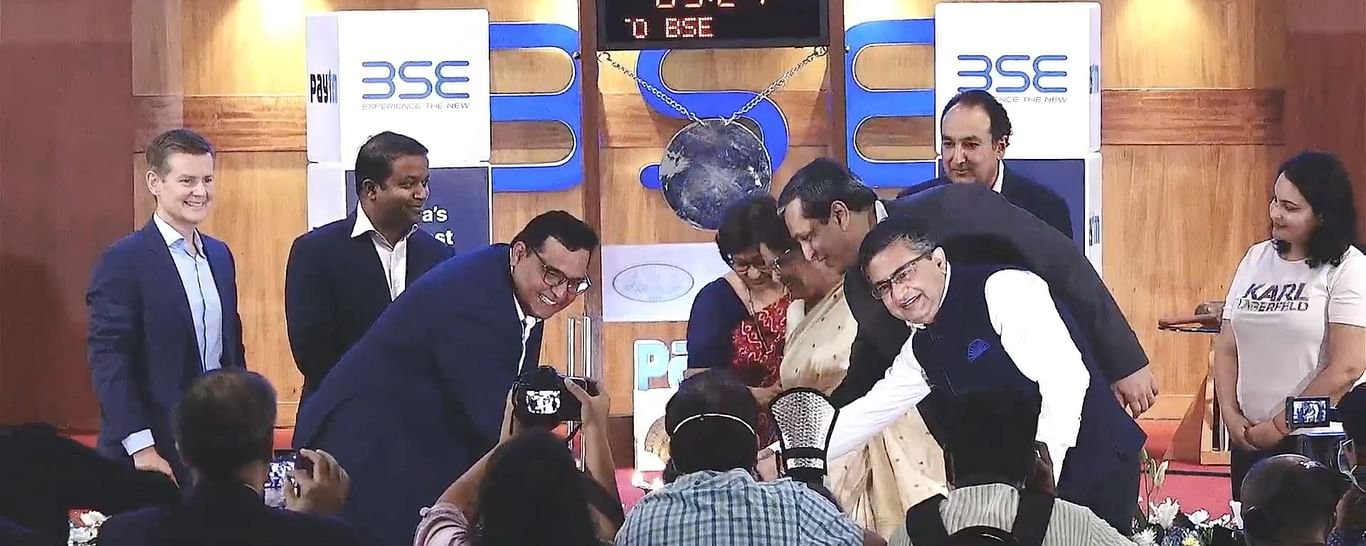

The Securities and Exchange Board of India (SEBI) has given a request identified with supposed insider exchanging by an undeniable level worker of Infosys Limited and one more representative of Wipro Limited, in the portions of Infosys Limited. In a request dated September 27, the blamed were distinguished as Rami Chaudhri for Infosys and Keyur Manair of Wipro, and SEBI said that the case was identified with an essential association among Infosys and Vanguard, a US venture company, in July last year. Both of them have been restricted from exchanging stock trades.

Forthcoming finish of definite examination, the request expresses that Ramit and Keyur are controlled from purchasing, selling or managing in protections, either straightforwardly or by implication, till additional orders. “On the off chance that Ramit Chaudhri and Keyur Maniar have any vacant situation in any trade subsidiary agreements, as on the date of the request, they can finish off/make right such open situations inside 90 days of the date of the request or at the expiry of such agreements, whichever is prior,” it adds.

SEBI said that Rami was the Solution Design head of Infosys and was related with the Vanguard bargain and “was sensibly expected to approach or be aware of the Unpublished Price Sensitive Information (UPSI),” which at first sight made him an insider. He is blamed for offering this delicate data to Keyur, who “exchanged the scrip of Infosys in the F&O portion only before the declaration of the Vanguard bargain and before long the declaration, thusly offloaded/made right his positions to such an extent that net positions were zero.”

SEBI said that Keyur had created continues of Rs 261.30 lakh in the exchanging. It additionally expressed that the two denounced had been in contact through successive telephonic correspondence and furthermore knew one another well as they had cooperated in Wipro business measure administrations (BPS) from March 2012 to December 2014. Expressing that the conduct of Keyur was not his ordinary exchanging conduct, the SEBI said that the two denounced had at first sight disregarded the arrangements of the SEBI Act and Prohibition of Insider Trading (PIT) Regulations, 2015.

The SEBI request additionally said that, “Ramit had utilized the two his versatile numbers to speak with Keyur. During the period from January 1, 2020 to September 18, 2020, Ramit and Keyur have settled on a few decisions between themselves.”